Dollar Dominance

Treasury Bonds as Trade War Leverage

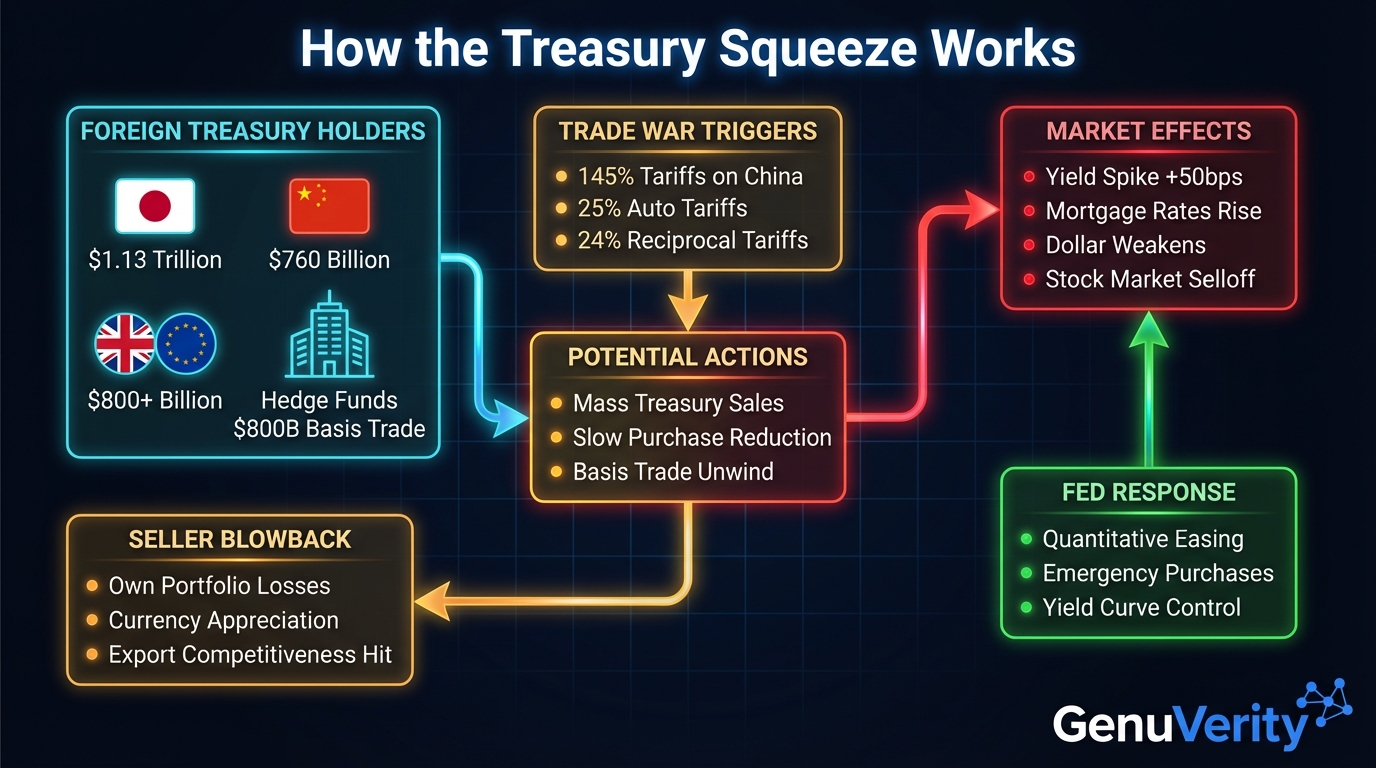

Foreign nations hold $8+ trillion in US Treasury securities. As tariffs escalate to 145%, could this debt become an economic weapon? Examining the leverage, the risks, and why the "nuclear option" may never be deployed.

Executive Summary

In April 2025, as President Trump raised tariffs on Chinese goods to 145%, global bond markets experienced their most violent week since 2020. Ten-year Treasury yields spiked 50 basis points in just days, triggering speculation that foreign nations were "weaponizing" their Treasury holdings in retaliation.

The reality is more nuanced. While China has steadily reduced its holdings from $1.3 trillion to $760 billion over the past decade, and Japan's Finance Minister Katsunobu Kato explicitly called Treasury sales a "card on the table," the April sell-off was primarily driven by hedge fund deleveraging of the $800+ billion basis trade—not coordinated foreign selling.

This analysis examines the leverage dynamics, why the "Treasury dump" remains a mutually assured destruction scenario, and how the Federal Reserve stands ready to neutralize any such attack.

How the Treasury Squeeze Works

Interactive diagram showing the economic leverage mechanism

The "Nuclear Option" Paradox

While China's $760 billion in Treasury holdings are often called a "financial weapon of mass destruction," deploying it would be mutually assured destruction. A rapid sell-off would:

1. Devalue China's remaining bond portfolio by billions

2. Force capital back into Beijing, strengthening the yuan

3. Make Chinese exports more expensive globally

4. Actually help the US achieve more favorable trade terms through dollar weakness

As Michael Brown of Pepperstone stated: "China selling down Treasury holdings would effectively be shooting themselves in the foot."

The April 2025 Sell-Off: What Really Happened

The April 2025 Treasury rout saw 10-year yields spike from 4.0% to 4.5%—the biggest weekly jump since 2001. While some blamed China, the evidence points elsewhere:

Hedge Fund Deleveraging: The $800+ billion "basis trade"—where funds use up to 100x leverage to arbitrage Treasury cash vs. futures—unwound violently as volatility spiked and prime brokers pulled financing.

Technical Evidence: As analyst Prashant Newnaha noted: "If China was selling, then front-end yields should be higher, but they are not. This selloff is primarily at the long end, speaking to broader investor reallocation."

The Fed's Countermeasure Capability

Even if foreign nations coordinated a Treasury dump, the Federal Reserve has demonstrated the ability to neutralize market disruptions:

March 2020 Precedent: When emerging market central banks dumped Treasuries to defend their currencies, yields spiked from 0.5% to 1.2% in one week. The Fed responded by purchasing $1.2 trillion in debt via quantitative easing, stabilizing the market within days.

Treasury Secretary Scott Bessent has stated that if the Fed "believed a foreign rival were weaponizing the US government bond market," they would take action—but emphasized "we just haven't seen that."

Holdings & Market Data

- Japan $1.13T

- China (Official) $760B

- United Kingdom $740B

- Cayman Islands (Hedge Funds) $418B

- All Central Banks Combined $3.8T

- 2013 Peak Holdings $1.32T

- January 2025 $761B

- Total Reduction -$559B

- Reduction Rate -42%

- Hidden Holdings (Est.) ~$240B

- 10Y Yield Peak 4.59%

- Weekly Yield Jump +50bps

- 30Y Yield >5.0%

- Worst Since 2001

- Basis Trade Exposure $800B+

- Current Holdings $1.13T

- % of Japan's GDP 25%

- April 2025 Sales $21B

- Kato Statement "Card on table"