Executive Summary

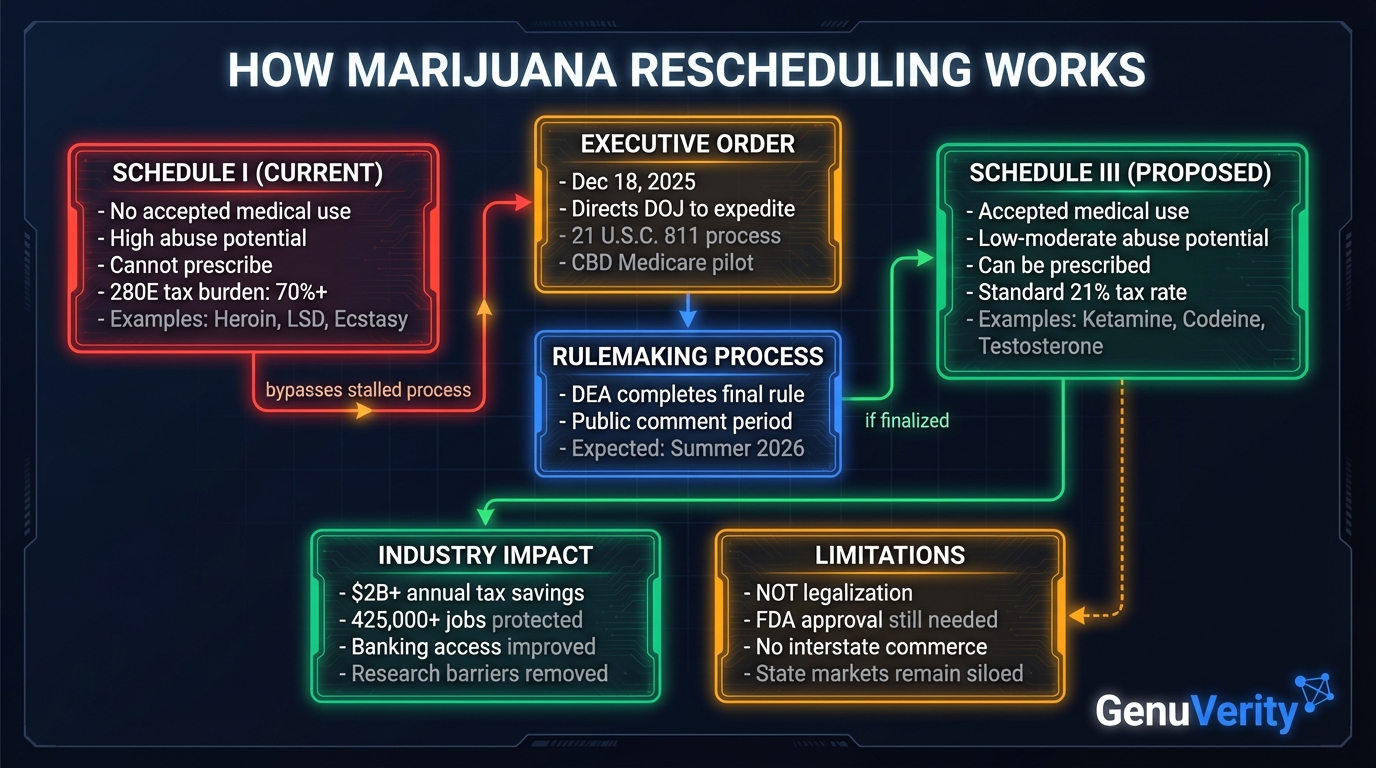

On December 18, 2025, President Trump signed an executive order directing the Department of Justice to expedite the reclassification of marijuana from Schedule I to Schedule III of the Controlled Substances Act. This represents the most significant shift in federal drug policy in over half a century.

The order does not legalize marijuana nationwide. Instead, it directs Attorney General Pam Bondi to complete the rulemaking process "in the most expeditious manner." The move would eliminate the crushing Section 280E tax burden that has forced cannabis businesses to pay effective tax rates of 70% or higher, potentially saving the industry $2+ billion annually.

What the Executive Order Does

The executive order, titled "Increasing Medical Marijuana and Cannabidiol Research," contains several key directives:

1. Expedited Rescheduling

The Attorney General is directed to "take all necessary steps" to complete the rulemaking process to move marijuana from Schedule I to Schedule III, following procedures under 21 U.S.C. 811. This finalizes a recommendation made by the Department of Health and Human Services in August 2023.

2. CBD Medicare Pilot Program

CMS Administrator Dr. Mehmet Oz announced a pilot program under CMS' Innovation Center that will allow Medicare beneficiaries to receive CBD at no charge starting April 2026, if recommended by their doctors.

3. Hemp-Derived Product Framework

The order directs collaboration with Congress to update statutory definitions for hemp-derived cannabinoid products, including THC milligram limits and CBD-to-THC ratio requirements.

Important Limitation

"It doesn't legalize marijuana in any way, shape or form and in no way sanctions its use as a recreational drug," Trump stated. The order is specifically aimed at helping people struggling with chronic pain, which affects nearly 1 in 4 U.S. adults.

Schedule I vs. Schedule III: What Changes

| Attribute | Schedule I (Current) | Schedule III (Proposed) |

|---|---|---|

| Medical Use | No accepted medical use | Accepted medical use with prescription |

| Abuse Potential | High potential for abuse | Moderate to low potential |

| Prescriptions | Cannot be prescribed | Can be prescribed by physicians |

| Research | Severe barriers to research | Easier research access |

| Tax Treatment (280E) | Cannot deduct business expenses | Standard deductions allowed |

| Other Drugs in Schedule | Heroin, LSD, Ecstasy, Peyote | Tylenol w/codeine, Ketamine, Testosterone |

The Road to Rescheduling

Economic Impact

Section 280E Tax Relief

The most immediate impact will be the elimination of Section 280E of the Internal Revenue Code, which prohibits businesses trafficking in Schedule I or II substances from deducting ordinary business expenses. This arcane provision has forced cannabis companies to pay effective tax rates exceeding 70%, compared to the standard 21% corporate rate.

According to MJBizDaily, the industry collectively overpays the IRS more than $2 billion annually in excess taxes. Between 2020 and 2030, total marijuana industry taxes with 280E applied are estimated to reach $65.3 billion.

Market Reaction

In the week leading up to the executive order, cannabis stocks surged dramatically. Canopy Growth gained 54%, Tilray Brands jumped 44%, and the Amplify Seymour Cannabis ETF (CNBS) rallied 54% for its best day on record.

However, on December 18 when the order was actually signed, stocks experienced a classic "sell the news" reaction, with many cannabis names among the day's underperformers.

Banking Access

Ed Groshans of Compass Point noted the change would be "positive" for allowing banks to serve the cannabis sector, potentially ending years of the industry operating largely in cash due to federal banking restrictions.

Limitations & Caveats

Not Legalization

Rescheduling does not federally legalize marijuana. Schedule III drugs are still tightly regulated, and none of the existing state-legal cannabis companies have FDA approval to traffic in Schedule III goods. Selling a Schedule III drug without proper federal licensure remains illegal.

Interstate Commerce Still Prohibited

Rescheduling leaves all current state marijuana markets siloed from each other. Interstate commerce in cannabis remains prohibited under federal law.

FDA Approval Hurdles

Industry experts warn that "the requirements for legal participation in a Schedule III market are burdensome, and it's unlikely that any significant portion of the industry will be able to properly participate" without navigating complex FDA drug approval processes.

How Marijuana Rescheduling Works

Bottom Line

The executive order represents a historic shift in federal drug policy and will deliver meaningful tax relief to the cannabis industry. However, it falls short of legalization and leaves significant regulatory hurdles in place. The real impact will depend on how quickly the DEA completes the rulemaking process and how state-legal operators navigate the complex requirements for participating in a Schedule III market.